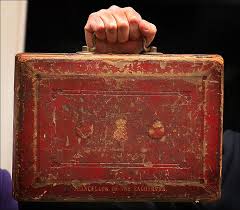

Every household and business in the UK could face an increase in insurance costs again, following a warning that the chancellor may target premiums in next week’s Budget; the second time within 12 months

The trade body for insurance brokers, the British Insurance Brokers Association (BIBA) has become aware of rumours circulating in Whitehall that George Osborne is planning another increase in Insurance Premium Tax (IPT).

The tax was raised from 6% to 9.5% in November 2015 and it is said it could rise to as much as 12.5% in next weeks budget.

Neil Grimshaw, Director of Ravenhall Risk Solutions, Chartered Insurance Brokers head quartered in West Yorkshire, has warned that this could have significant implications for anyone who purchases insurance whether that be for business or for personal. “This would demonstrate a 108% increase in tax on insurance products within a year. Such a rise could add £37 a year to the average car insurance premium, and hundreds of pounds to thee cost of business insurance for SMEs. This all comes on top of a 58% rise in the tax which hit consumers in November 2015”

“IPT is charged on motor, home, pet, and medical insurance, as well as Business insurance.”

“At Ravenhall we are concerned that pressure on IPT will lead to consumers and businesses cutting cover. This is a tax on risk, and it is unacceptable that consumers are being hit on the pocket by a stealth Tax.

The British Insurance Brokers’ Association (Biba) said a rise in IPT would discourage customers from taking out policies.

Ends

NG