Over the last 12 months, the cost-of-living in the UK has increased faster than it has in over a decade. People have seen costs increase across all raw materials, food, and fuel. With inflation rates rising by 7.0% in the past 12 months up from 6.2% in February 2021, people are certainly feeling the pinch. This increase has also seen an increase in the cost of insurance premiums for both commercial and domestic customers. With no sign of things slowing down just yet, we need to be prepared for the impact of the changes we’re seeing in the UK economy.

As well as considering budgeting and costs for your day to day lifestyle, thinking ahead is also key in this uncertain time.

As a Chartered Insurance Broker, Ravenhall Risk Solutions aim to provide you with the best and most up to date advice. We support our customers with any changes to their circumstances and will ensure that their policies reflect the current and future environments. Within this blog, we aim to guide you through how the rising cost of living can impact your insurance, and what to do about it.

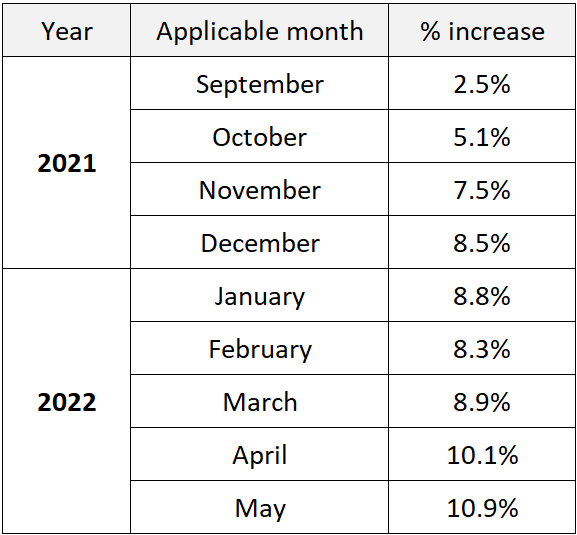

The immediate effect of inflation in terms of any insurance policy are the pressures it puts on sums insured, to replace buildings and contents whether personal or in business simply costs more and that puts pressures on sums insured. Index linking is how we try and resolve the annual difference between sums insured and in periods of high inflation this is important to remain well insured, but also increases costs. The purpose of index linking is to ensure that property is not undervalued during the period of the policy. As mentioned, the cost of raw materials has seen substantial rises in the last 2 years, with many materials hard to get hold of. Therefore, this will impact the cost of things like buildings rebuild values should anything happen to it.

As you will see from the table, indexation has increased significantly over the last few months, and this is having an impact on the cost of insurance premiums.

Claims inflation is impacted by a number of external and environmental factors. Some of which include:

Brexit

Covid

Societal trends

Combined, these industry challenges continue to drive up the cost of building repair, replacing contents, repairing vehicles and re-construction, both in the UK and globally, with little respite expected in the overall supply chain before 2023

Recent data from the Royal Institute of Chartered Surveyors (RICS) has highlighted that on average, buildings are covered for just 68 per cent of the amount they should be in the UK. With rebuild costs rising rapidly, the current situation is likely to become even worse. A common misconception amongst homeowners is to confuse the rebuild value of a property with its market value. In certain geographic locations the rebuild value can be significantly higher, as an insurer must also pay for items such as the cost of demolition, landfill tax and professional fees such as architects and planning permission costs, in addition to the cost of repairs.

One of the most important things you can do is to make sure you have an up-to-date valuation for the full cost of rebuilding your property, the cost of replacing contents and similar asset-based schedules. Keeping this valuation current is the responsibility of the policy holder, and there may be little we can do should sums fall short.

As a rule of thumb, these valuations should be undertaken every 5 years. If you need advice on where to get a valuation, we can put you in touch with professional valuers for both building and contents.

On the residential rebuild values, these differ to the properties market value and there is a free tool online that can help you calculate the rebuild of a property which can help residential property owners ensure they are adequately insured. We would recommend checking the properties on here every few years to ensure that the rebuild value is adequate.

On commercial properties, if you haven’t had a rebuild cost assessment in the last 5 years we would strongly recommend that you consider this, a chartered surveyor can provide a RCA (Rebuild cost assessment) and this will ensure that you have the correct sum insured for the property which will assist in ensuring that you pay the right premiums and also ensure that in the event of a claim underinsurance does not become an issue. Ravenhall have some close links with facilities providers that do on site assessments and some that do online assessments if you would like further information please let us know.

If your insurance is due for a renewal in the next 6 months, Ravenhall Risk Solutions would recommend looking for a valuation of your property now. Having this information to hand before your renewal will allow our team to put the right policy in place. If you would like to query the cost of your renewal, our team will gladly speak to you about the policy and how you’re protected.

Get in touch if you would like to chat to a member of our team.

Ravenhall Risk Solutions is a trading name of Jensten Insurance Brokers (Yorkshire & Humberside) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: Salts Wharf, Ashley Lane, Shipley, West Yorkshire BD17 7DB. Registered in England No: 00371448.

View the Ravenhall Group Commercial Terms & Conditions and Consumer Terms & Conditions © 2023 Ravenhall Risk Solutions